3110 Old McHenry Road

Long Grove, IL 60047

Phone: 847.634.9440

Office Hours:

Monday- Friday

8 am – 4:30 pm

Many taxpayers are surprised to learn that the Village of Long Grove is among approximately 3% of villages and cities in the State of Illinois that do not impose a municipal property tax. The Village maintains a balanced budget with a variety of revenue sources other than property taxes (e.g., sales tax, investments, permits, licenses, and fees) while maintaining desired services for its residents. This is one of many reasons to think and shop local, which supports both businesses and essential Village operations that are funded through sales tax dollars.

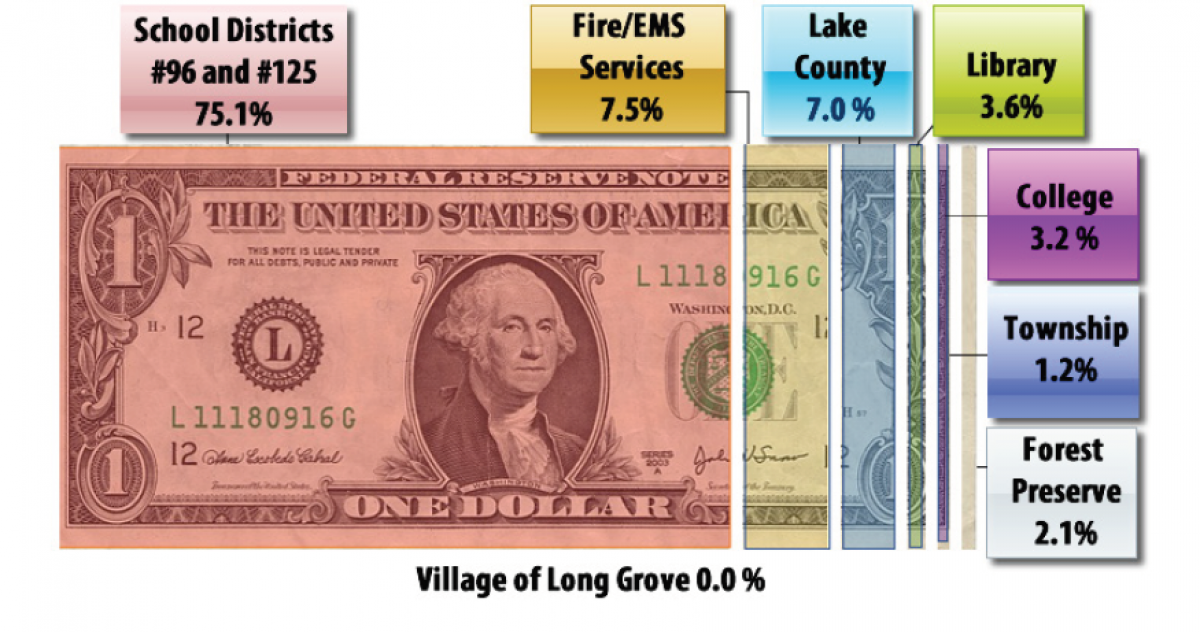

*The dollar bill image at the top of this page includes approximate 2018 percentages of tax dollars allocated to each taxing district in the Village of Long Grove (average between Ela and Vernon township). The Dollar Bill is broken into School District #96 and #125 (75.1%), Fire/EMS (7.5%), Lake County (7.0%), Library (3.6%), College (3.2%), Township (1.2%) and Forest Preserve (2.1%). To learn more about your tax bill and view the PDF version of the dollar bill, click The Bridge Newsletter link at the bottom of this page and scroll to page six.

The Village of Long Grove collects a 1% sales tax village-wide with the following additional sales taxes limited by the type of item purchased and the location of the purchase:

Municipal Sales Tax = 1%. The State of Illinois charges 7.0% sales tax and distributes 1.0% of this tax back to Long Grove.

Non-home Rule (Infrastructure) Sales Tax = 1%. The Village of Long Grove charges an additional 1.0% non-home rule sale tax that excludes food and drug purchases.

Business District Sales Tax = 1%. Limited non-food/drug purchases and limited to the development located at the southeast corner of Aptakisic Road and IL Route 83.

Telecommunications Tax – 5.75%.

Please click here for a link to the fee schedule in the Village Code (Enter Fees and Costs into the Long Grove Village Code search tab).